Crossborderit IOSS and DDP

Featured images gallery

Highlights

-

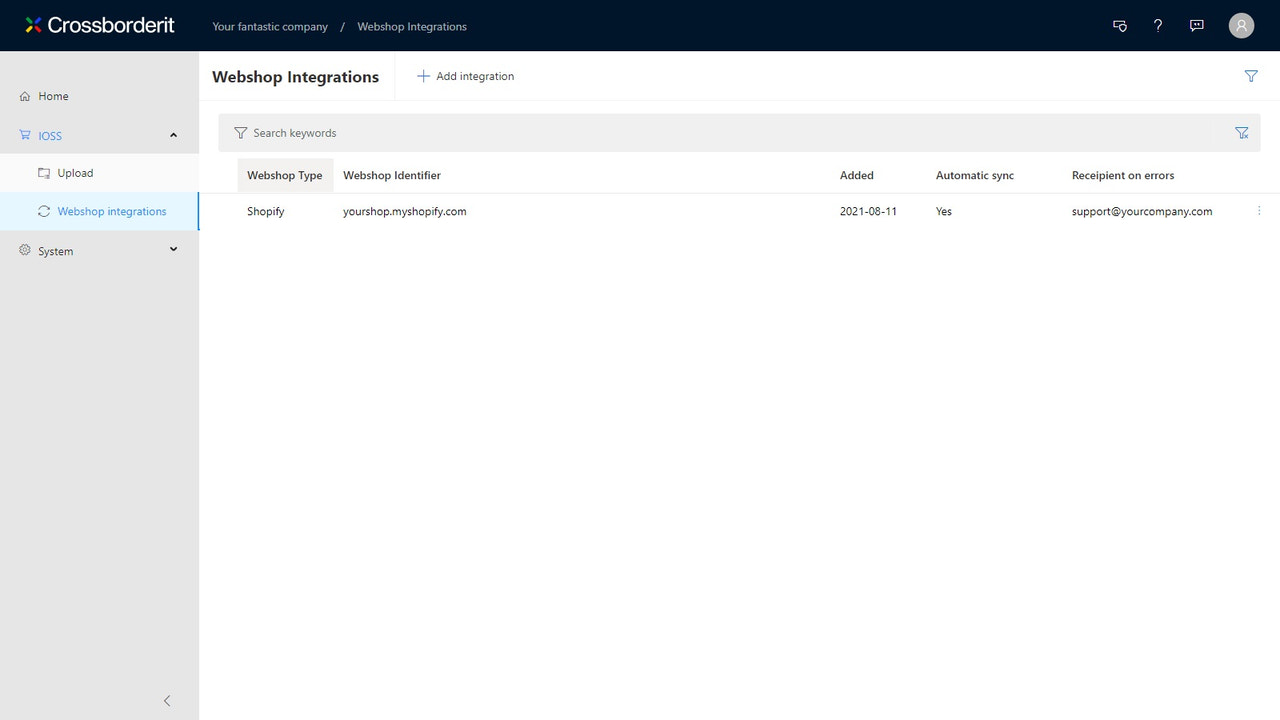

Use directly in Shopify admin

About this app

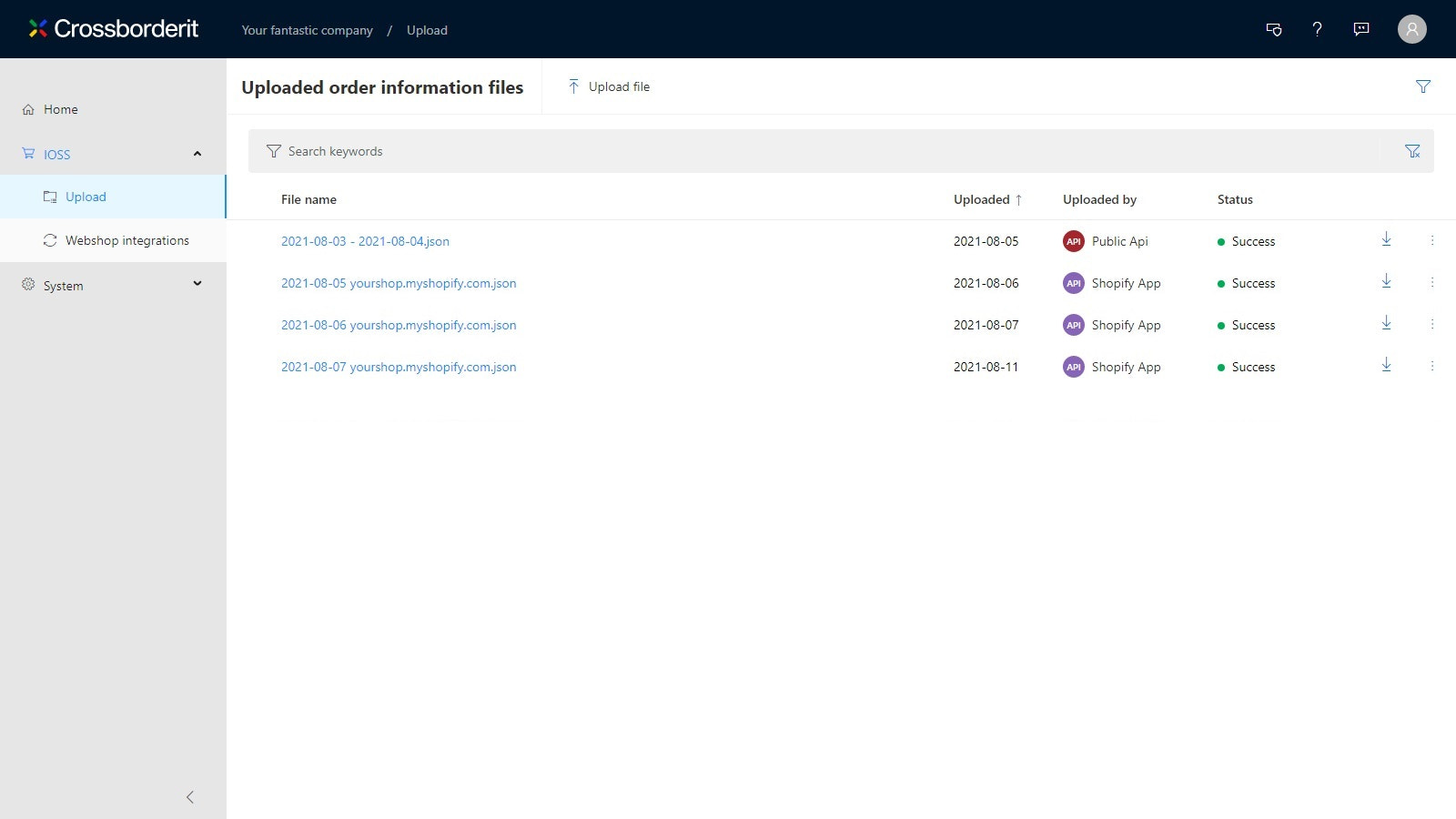

Automates IOSS "European One Stop Shop" Allows shipping of Low-value goods to Europe, Compliantly

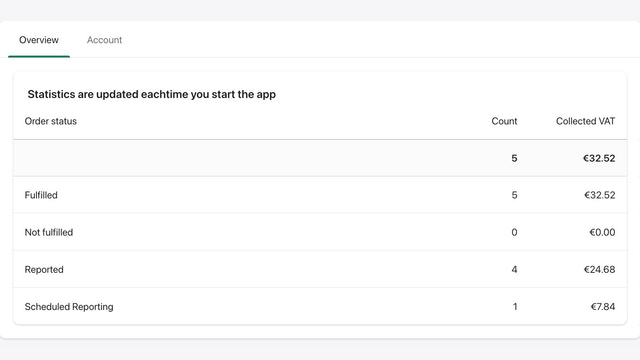

Fully Automated, Reporting and Compliance for IOSS. Ability to pay tax authorities on your behalf and support you as an intermediary. Simple process, with a Flat fee that can be handed down to your buyers at the checkout. Low-cost solution that allows buyers to pay their VAT(sales tax)

- Automated Sync of Sales, Reporting and compliance.

- Full Visibility and reporting for all shipments

- Flat fee that can be seen in check-out and passed on to your customers

Pricing

External charges may be billed by Crossborderit AB separately from your Shopify invoice. Learn more

Free

Free

All charges are billed in USD. See all pricing options

18 reviews

CrossborderIT was a good solution for us until they changed their pricing from 1EUR per transaction to 99EUR per month despite their terms stating "CBIT shall have the right to change the fees for the Services at any time by giving the Customer no less than 30 days’ notice.", stopped replying to live chat messages and removed the live chat function. We cannot find any option to cancel our service but will be doing so as soon as we possibly can.

At the start, when everyone was running around like chickens with their heads cut off, along came Crossborderit with a simple(ish) solution. Yay!

We signed up at the very outset.

It wasn't always too clear what we were actually being charged and we put in a lot of work trying to reconcile our charges with what we had sold. We even had a letter from the Swedish tax authorities saying we'd possibly underpaid an item.

But hey-ho, it was still a solution!

Now I get an increase of 4 - or is it 500% in the charges?

I don't think so!

This would make our meagre sales into the EU actually cost us money. It wouldn't just reduce our profit, it would actually cost us money to sell into Europe.

I notice that Crossborderit say that they only have 2 negative reviews out of 400 daily users. I wonder when they made their count of 400? I wonder how many of those 400 are biding their time until the price-hike hits.

We will certainly be jumping ship for a more cost-effective solution.

Thanks for working with us. We were stuck in to the confusion of the tax authorities. We got that sorted out but totally understand not being a good fit.

Been Ok for 12 months but they've pushed the price to $99 per month, no options for small businesses. You need to be sending a lot to warrant this price and there are still better options. We now use EAS, way better value for us.

Some of my orders weren't showing up in Crossborderit. It took 6 weeks and a lot of back and forth with support before the developer finally discovered that there was a bug in their Shopify integration. The developer seems to be very uncommunicative and slow to find and resolve bugs -- the support team told me that the developer was unavailable for an entire month, and then it took another full month after they returned to resolve the bug. They seem to only have one developer so there's no redundancy if he's on vacation.

In combination with them increasing their prices to 99 euros/month, I definitely wouldn't recommend this service.

Started with a fair and transparent pricing model but started adding new fees, now have added a 99 euro monthly charge. Would not recommend.

About this app

Built by Crossborderit AB

About Crossborderit AB

1.3 average rating

2 years building apps for the Shopify App Store

Olivecronas väg 10, Stockholm, 11361, SE

Support

Send a messagesupport@crossborderit.com

More apps like this