India GST App

Vorgestellte Bildergalerie

Über diese App

Eingeführt

24. März 2021

Kategorien

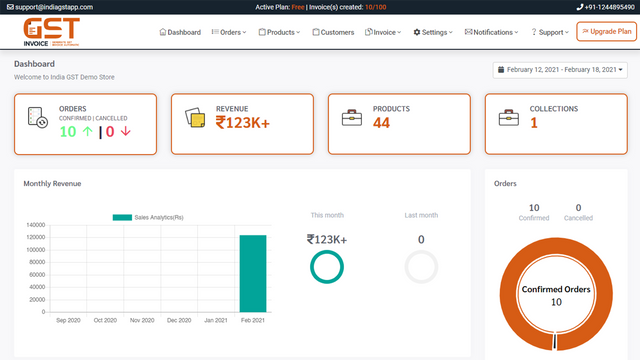

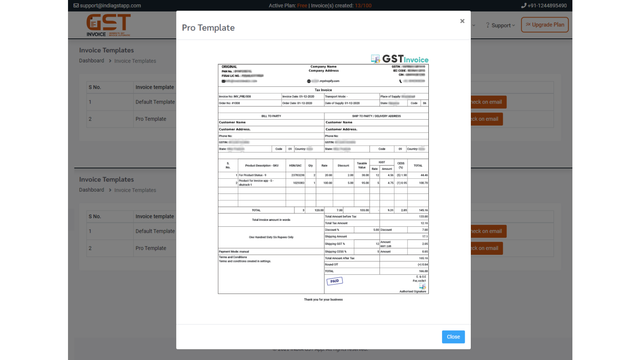

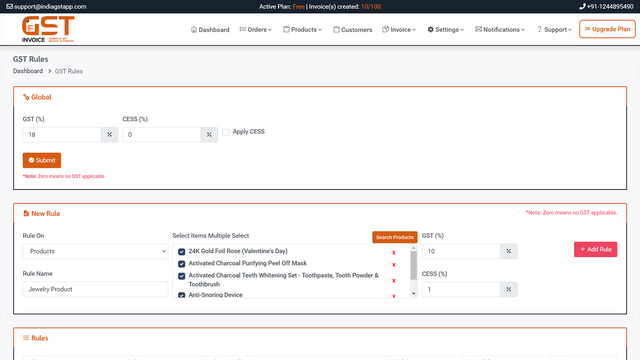

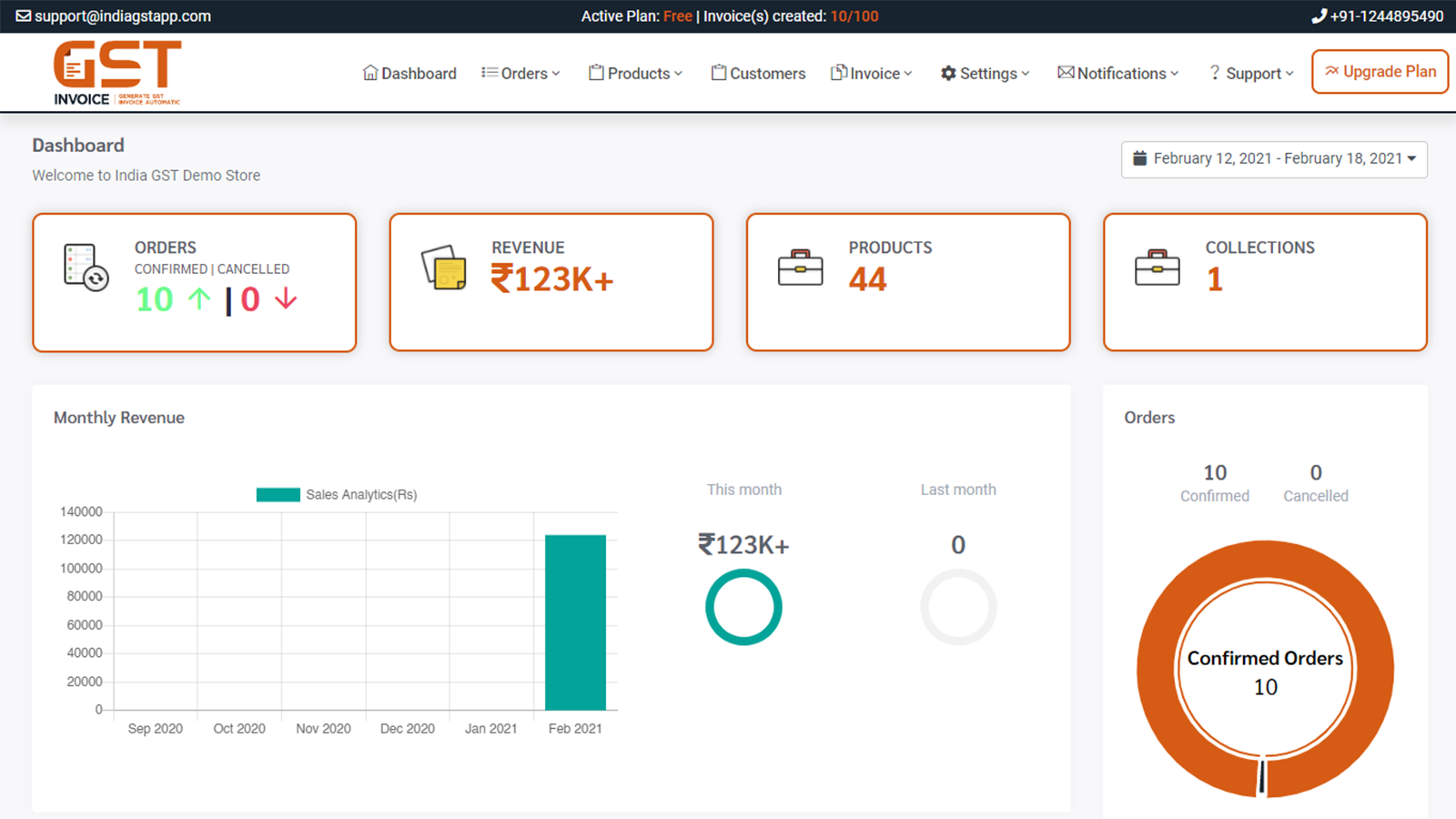

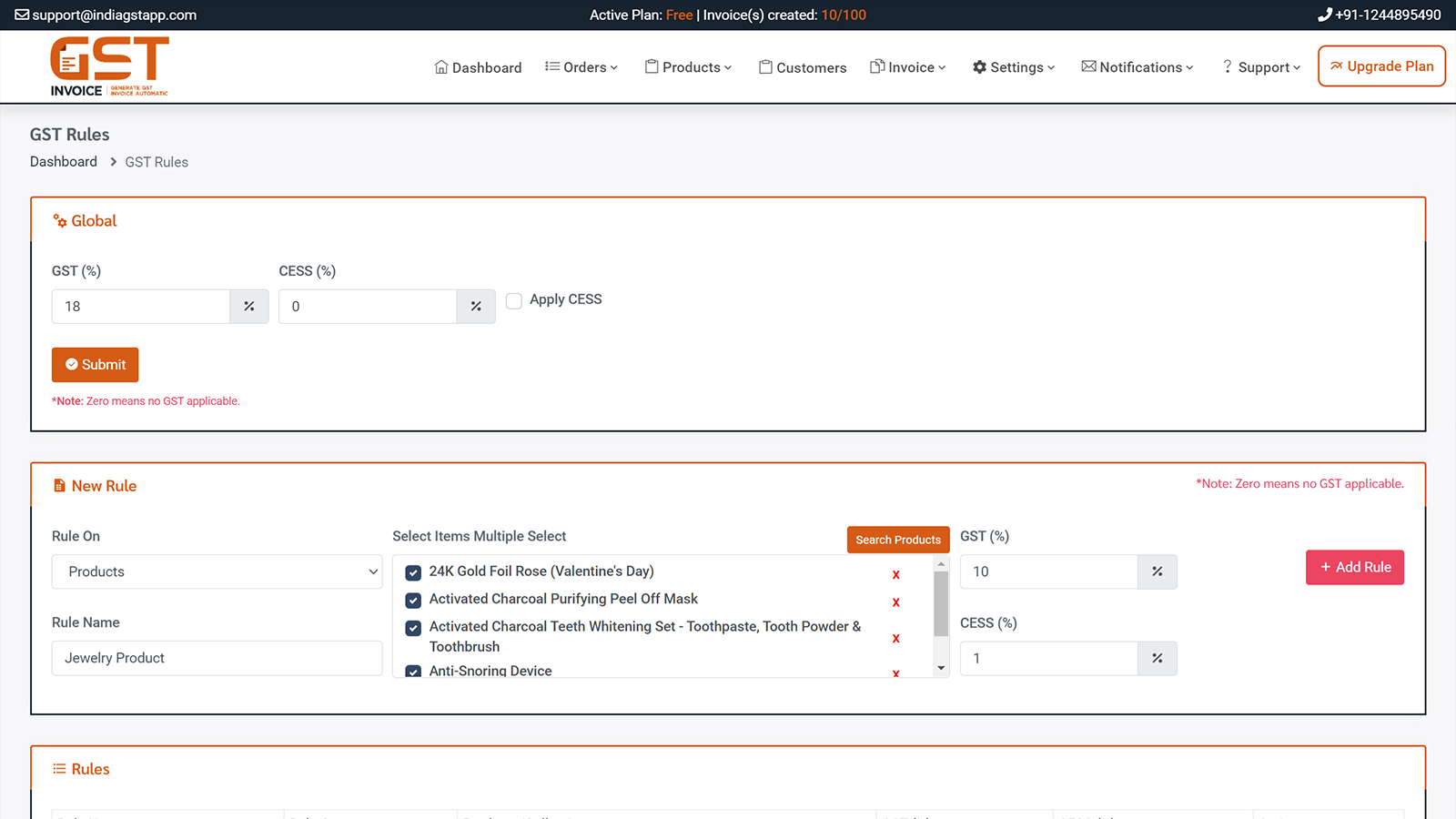

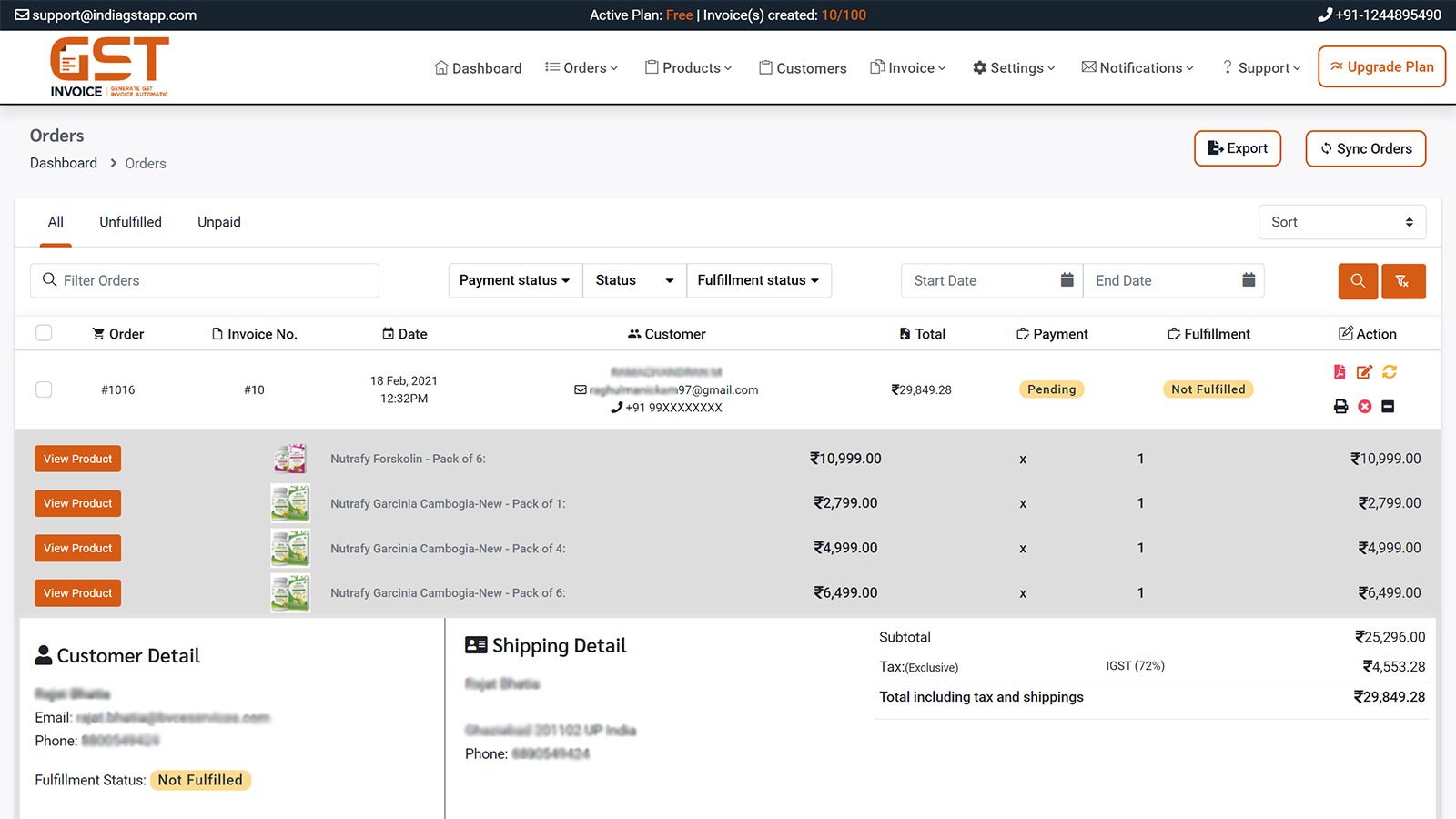

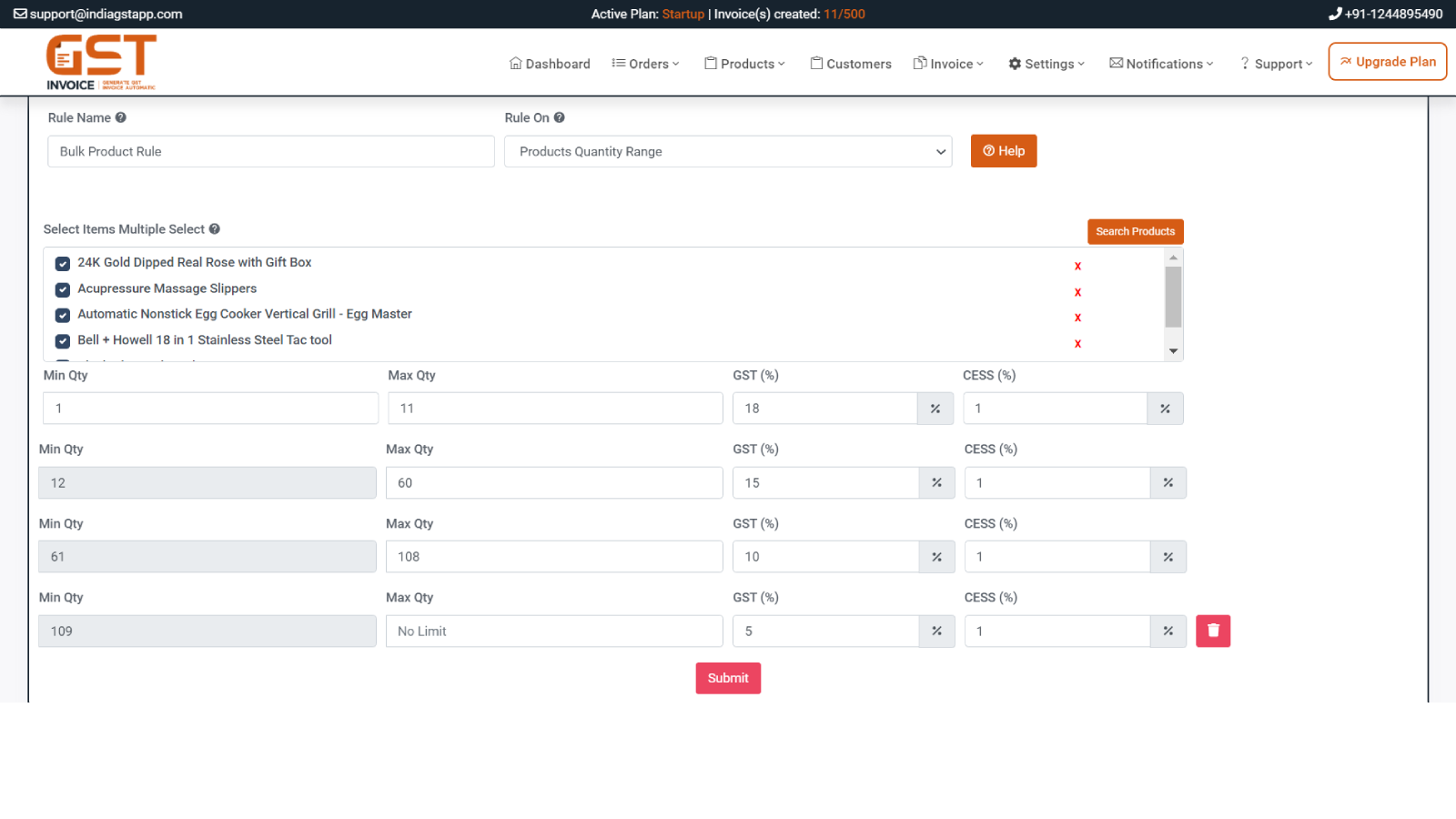

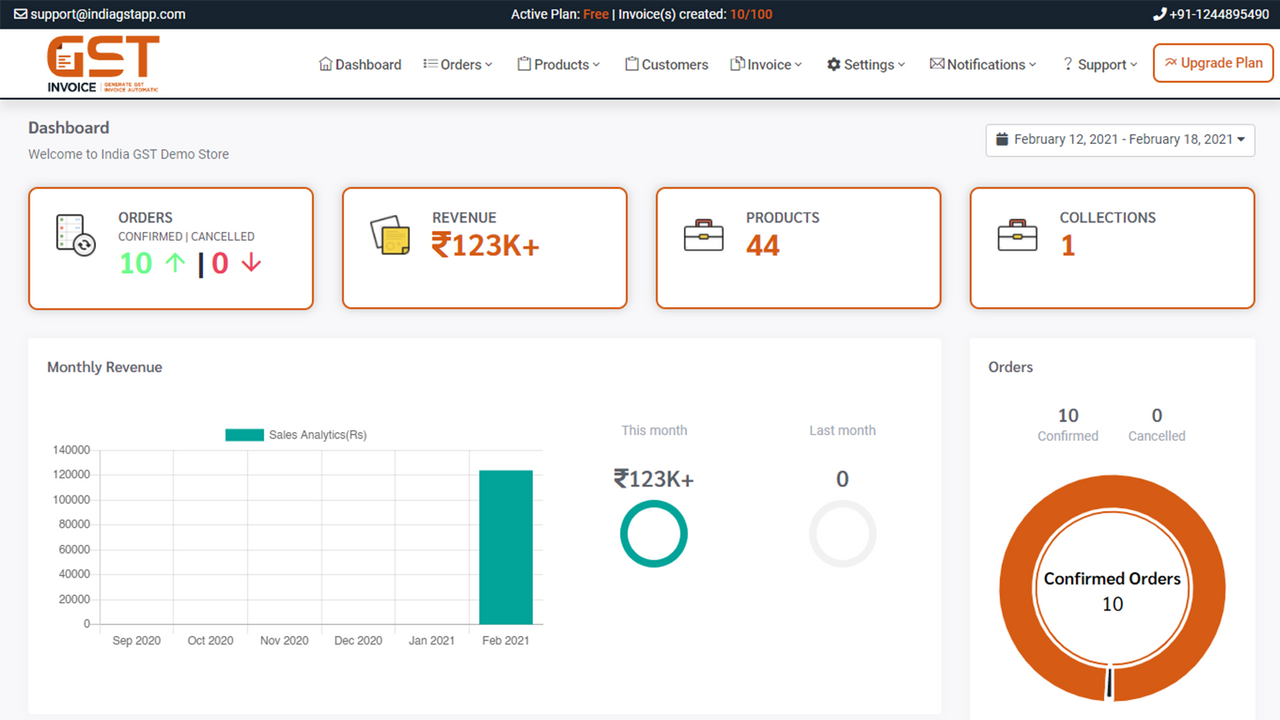

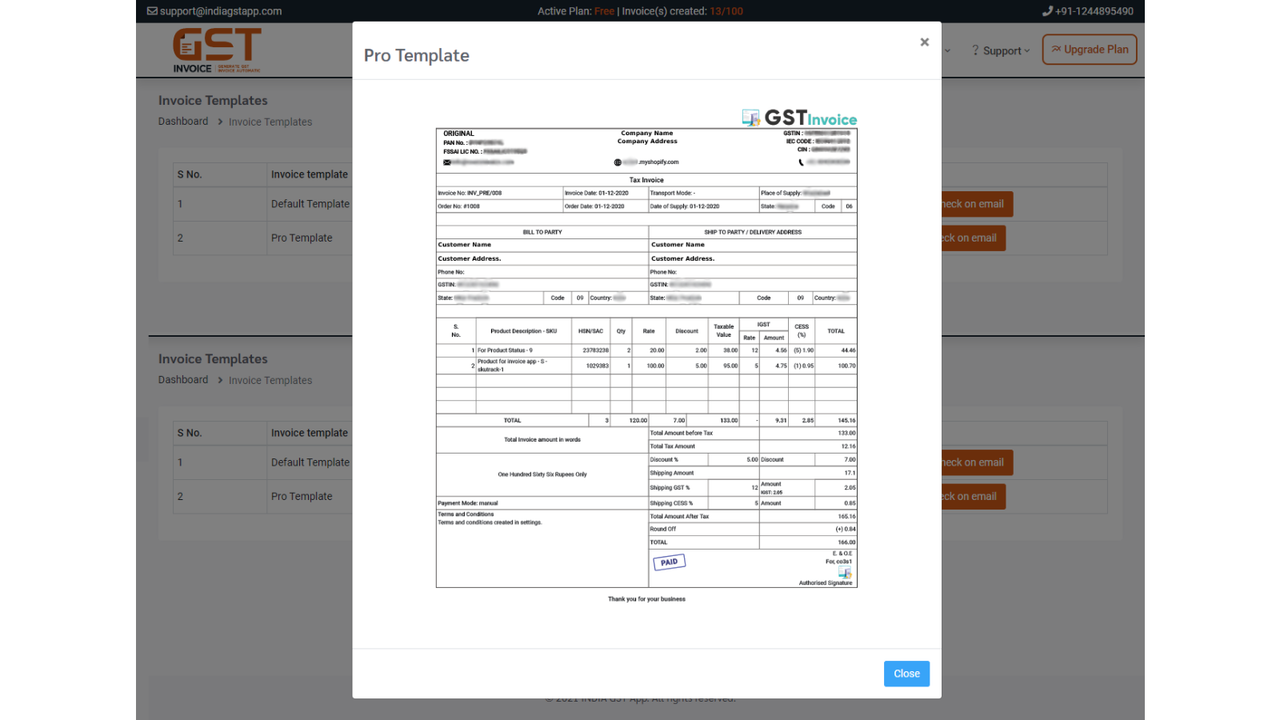

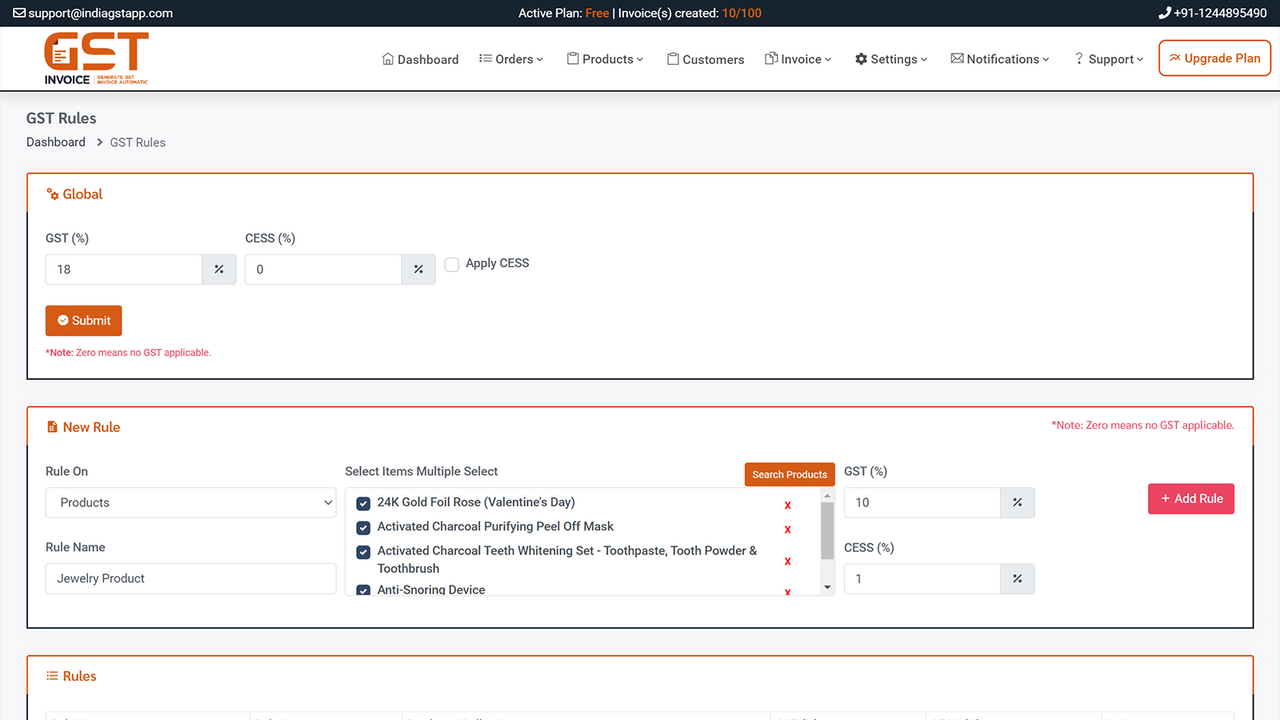

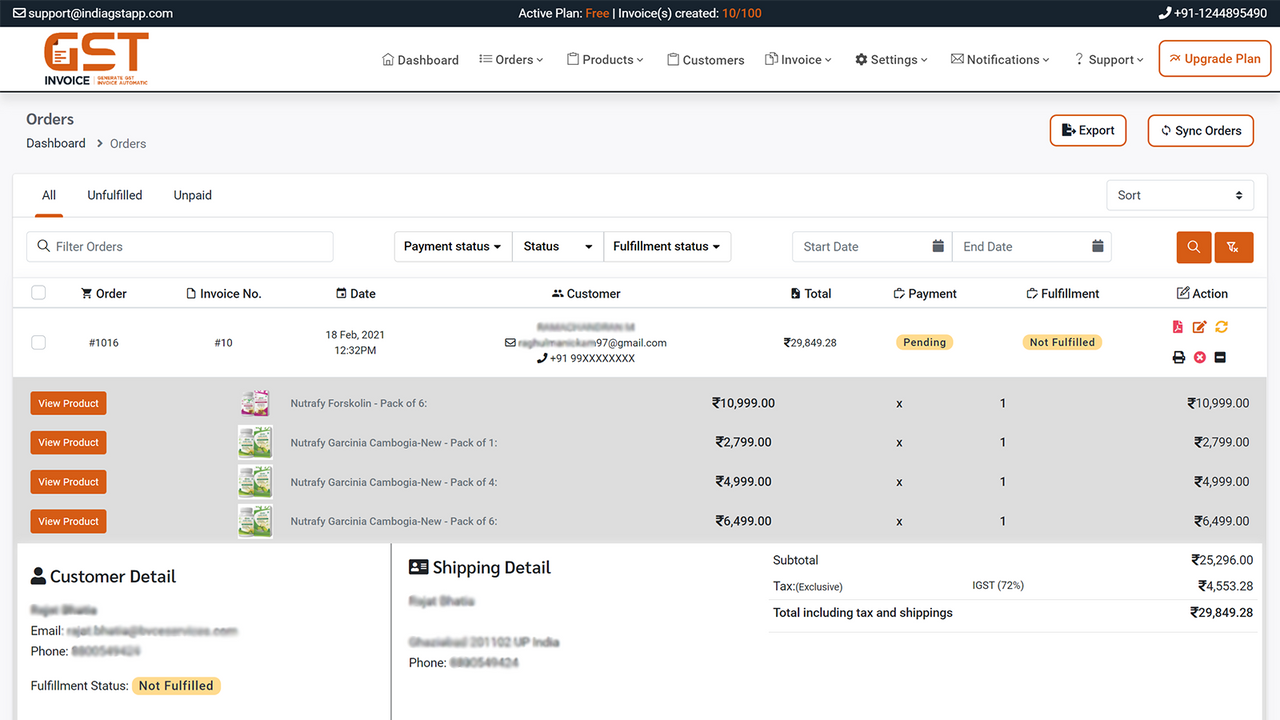

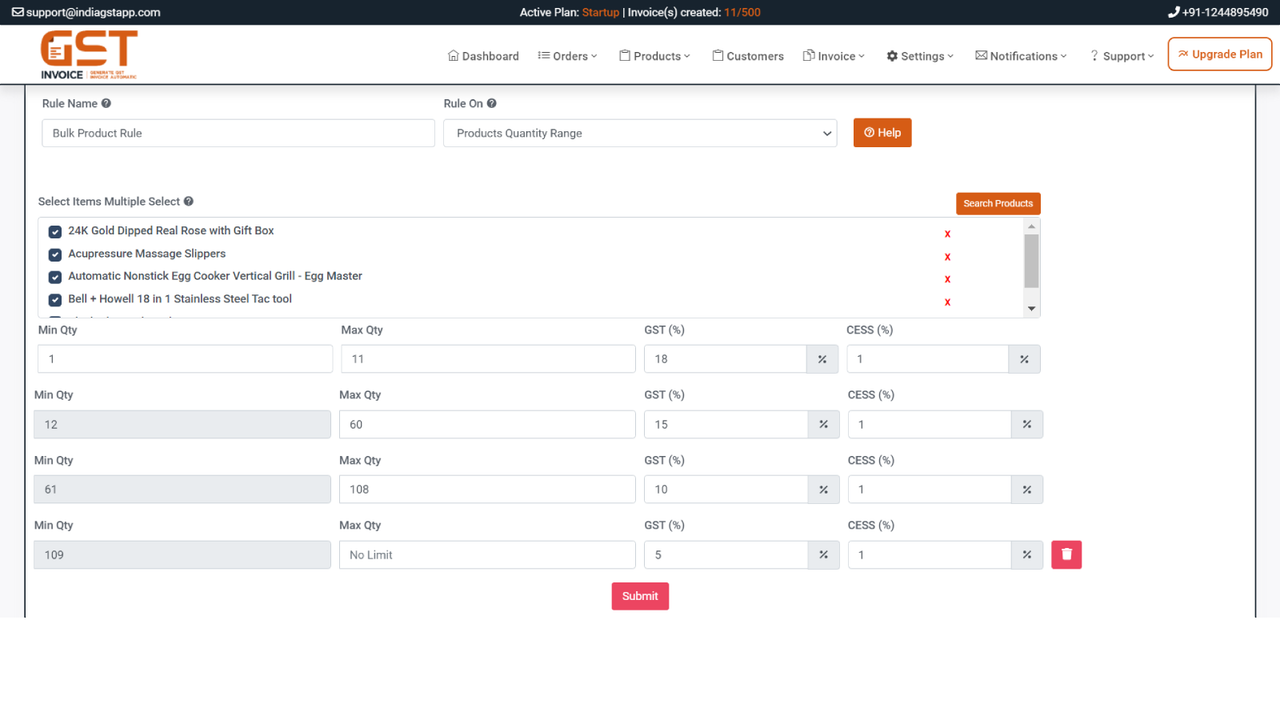

Marketinganalyse , Bestellung synchronisiert#Über GST-Rechnung Indien Erzeugen Sie Rechnungen mit GST-Details Erzeugen Sie einfach GST-Rechnungen, ohne Ihre Bestelldaten in Drittsoftware zu importieren, mit der GST-App. Die App holt Bestelldaten auf unkomplizierte Weise ab und erzeugt GST-konforme Rechnungen. #Produkt HSN-Code Jetzt müssen Sie HSN-Codes nicht mehr manuell in dieser App hinzufügen. Unsere App wird den HSN-Code automatisch von Ihrem Shopify-Store synchronisieren, wenn er dort hinzugefügt wurde. #GST-Einstellungen...

Enthält automatisch übersetzten Text

Preisgestaltung

7-tägiger kostenloser TestKostenlos

Kostenlos

- Bis zu 50 Rechnungen/Monat

- Alle Funktionen enthalten

Startup

$9/Monat

- Bis zu 500 Rechnungen/Monat

- Alle Funktionen enthalten

- E-Mail-Support

Medium

$29/Monat

- Bis zu 3000 Rechnungen/Monat

- Alle Funktionen enthalten

- E-Mail-Support

- Benutzerdefinierte Rechnungsvorlagen

- SMTP-Einstellungen

- SMS-Rechnung

Erweitert

$49/Monat

- Unbegrenzte Rechnungen/Monat

- Alle Funktionen enthalten

- E-Mail/Telefon-Support

- Benutzerdefinierte Rechnungsvorlagen

- SMTP-Einstellungen

- SMS-Rechnung

- Multi-Kanäle/Läden

Kostenlos

Kostenlos

- Bis zu 50 Rechnungen/Monat

- Alle Funktionen enthalten

Startup

$9/Monat

- Bis zu 500 Rechnungen/Monat

- Alle Funktionen enthalten

- E-Mail-Support

Medium

$29/Monat

- Bis zu 3000 Rechnungen/Monat

- Alle Funktionen enthalten

- E-Mail-Support

- Benutzerdefinierte Rechnungsvorlagen

- SMTP-Einstellungen

- SMS-Rechnung

Erweitert

$49/Monat

- Unbegrenzte Rechnungen/Monat

- Alle Funktionen enthalten

- E-Mail/Telefon-Support

- Benutzerdefinierte Rechnungsvorlagen

- SMTP-Einstellungen

- SMS-Rechnung

- Multi-Kanäle/Läden

Enthält automatisch übersetzten Text

Alle Gebühren werden in USD berechnet. Wiederkehrende und nutzungsabhängige Gebühren werden alle 30 Tage in Rechnung gestellt.

7 Rezensionen

- 100 % der Bewertungen sind 5 Sterne

-

0 % der Bewertungen sind 4 Sterne

-

0 % der Bewertungen sind 3 Sterne

-

0 % der Bewertungen sind 2 Sterne

-

0 % der Bewertungen sind 1 Sterne

I had been looking for an app to integrate my shopify store with for GST invoices and this app exactly solves my issues. It linked up seamlessly and generates invoices with the GST application. The customer care is excellent! Thank you so much!

We at Eauto have been using the Paid plan of the India GST app for more than 6 months now. We discovered this app after trying a few different GST apps - none of which were reliable or up to the mark. In addition, to the functionalities, we have also had a very good experience with their support. In short, we at Eauto highly recommend their app

Thank you so much for your kind words. We really appreciate you taking the time out to share your experience with us. We count ourselves lucky for customers like you and look forward to working with you again in the future!

Many Thanks,

Team India GST

i have used this app to generate gst bill and this app is really awesome, after that my bill related work is very simple and easy.

Thank you so much for your valuable feedback and rating. We really appreciate you taking the time out to share your experience with us. We count ourselves lucky for customers like you and look forward to working with you again in the future!

Many Thanks,

Team India GST

This is very useful gst invoice app. Very dedicated support team, they are giving fast solution on all my queries. I am using their free plan even though their support was extraordinary. Recommending to all shopify users.

I was looking for a solution for my invoicing and Order GST reports. Perfect app. Made our lives easier. Go for it!

Thank you so much for your valuable feedback and rating. We really appreciate you taking the time out to share your experience with us. We count ourselves lucky for customers like you and look forward to working with you again in the future!

Many Thanks,

Team India GST

Über diese App

Eingeführt

24. März 2021

Kategorien

Marketinganalyse , Bestellung synchronisiertEntwickelt von BVC e-Services Pvt Ltd

Über BVC e-Services Pvt Ltd

Durchschnittliche Bewertung: 5,0

3 Jahre Erfahrung in der Entwicklung von Apps für den Shopify App Store

1st Floor, Wing-B, AIHP Signature, 418 & 419, Udyog Vihar Phase 4, Gurugram, HR, 122015, IN

Support

Nachricht senden01244895490

support@indiagstapp.com

Ressourcen

Mehr Apps wie diese