Tax Rex ‑ Sales Tax Automation

Featured images gallery

Highlights

-

Based in United States

-

Use directly in Shopify admin

About this app

US State Sales Tax return Reports & Automated Filing for your store. Easy, Accurate & Time Saving!!!

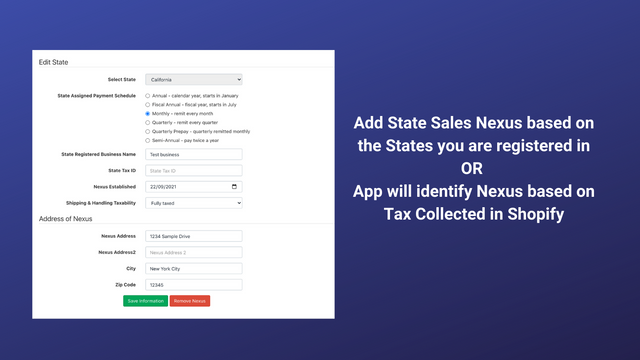

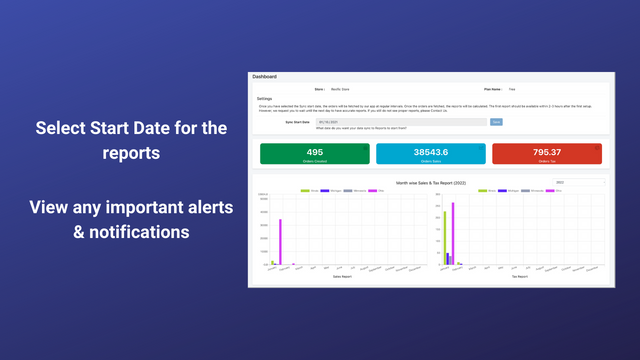

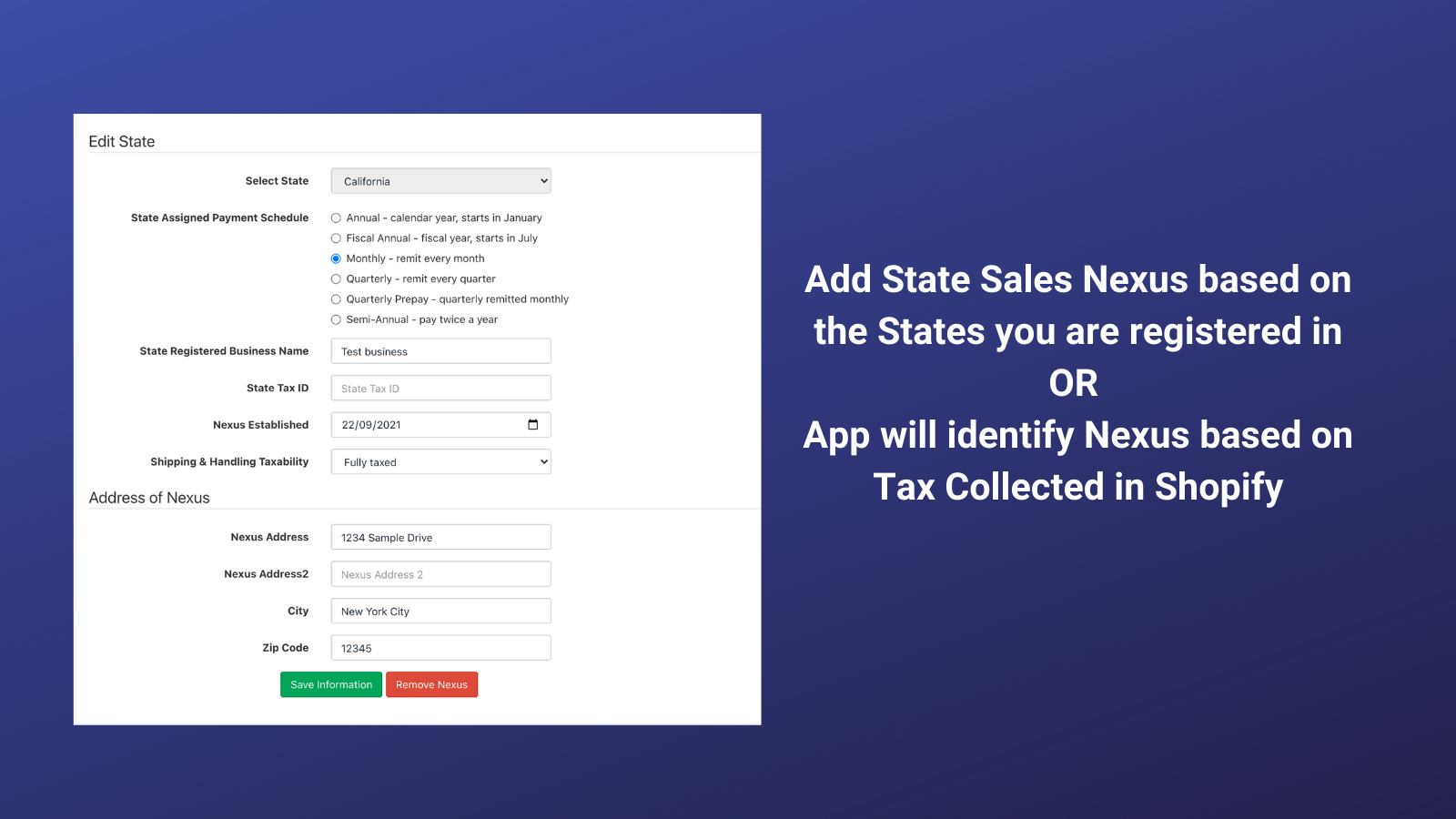

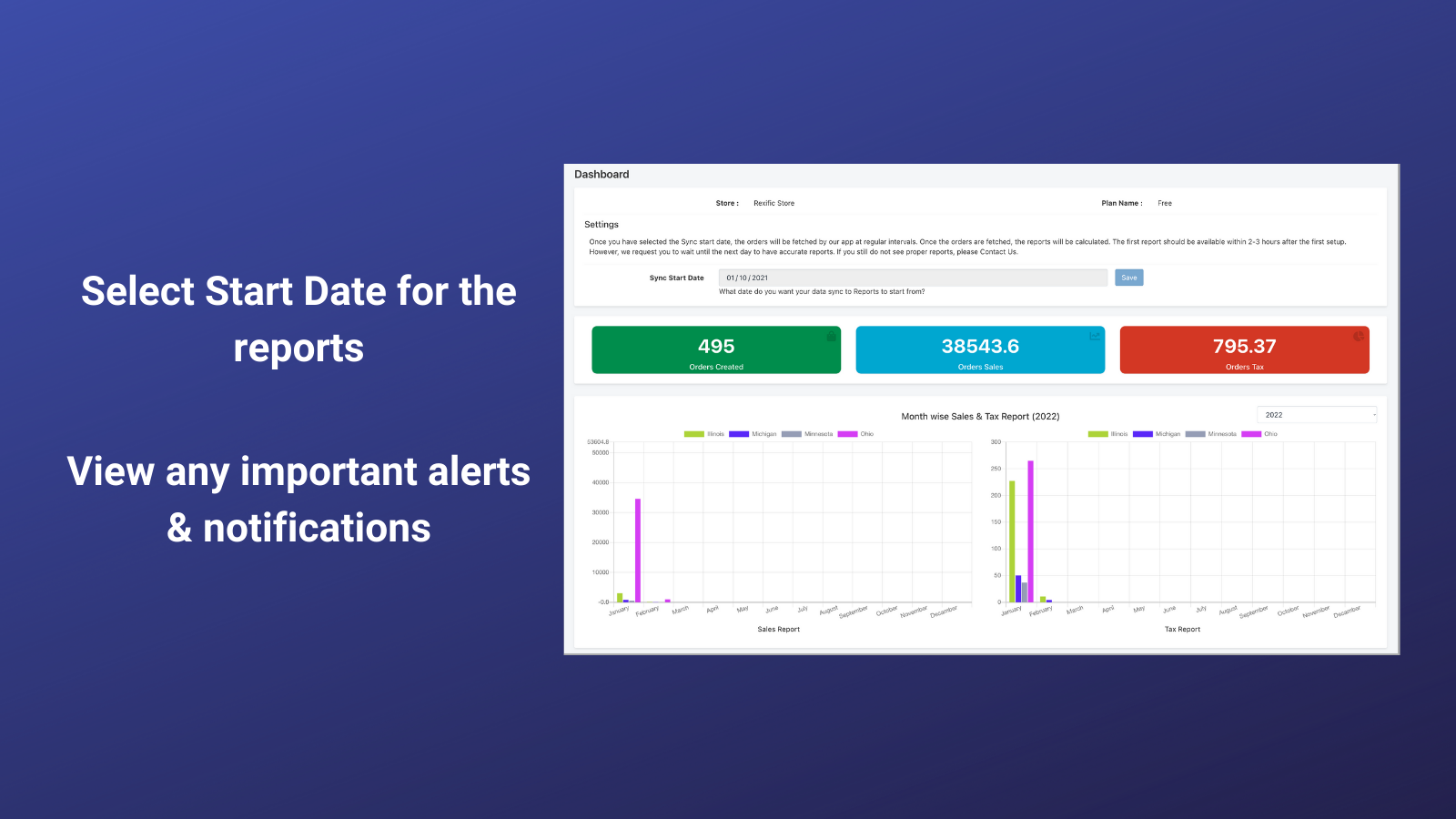

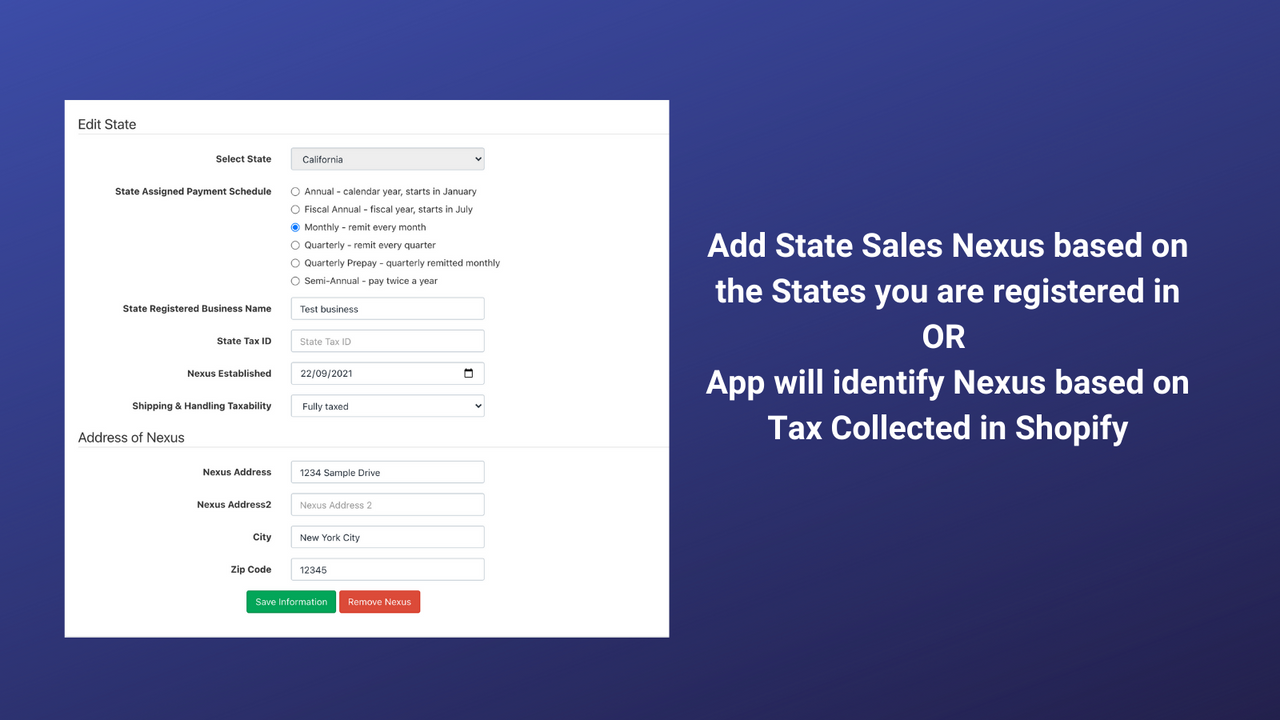

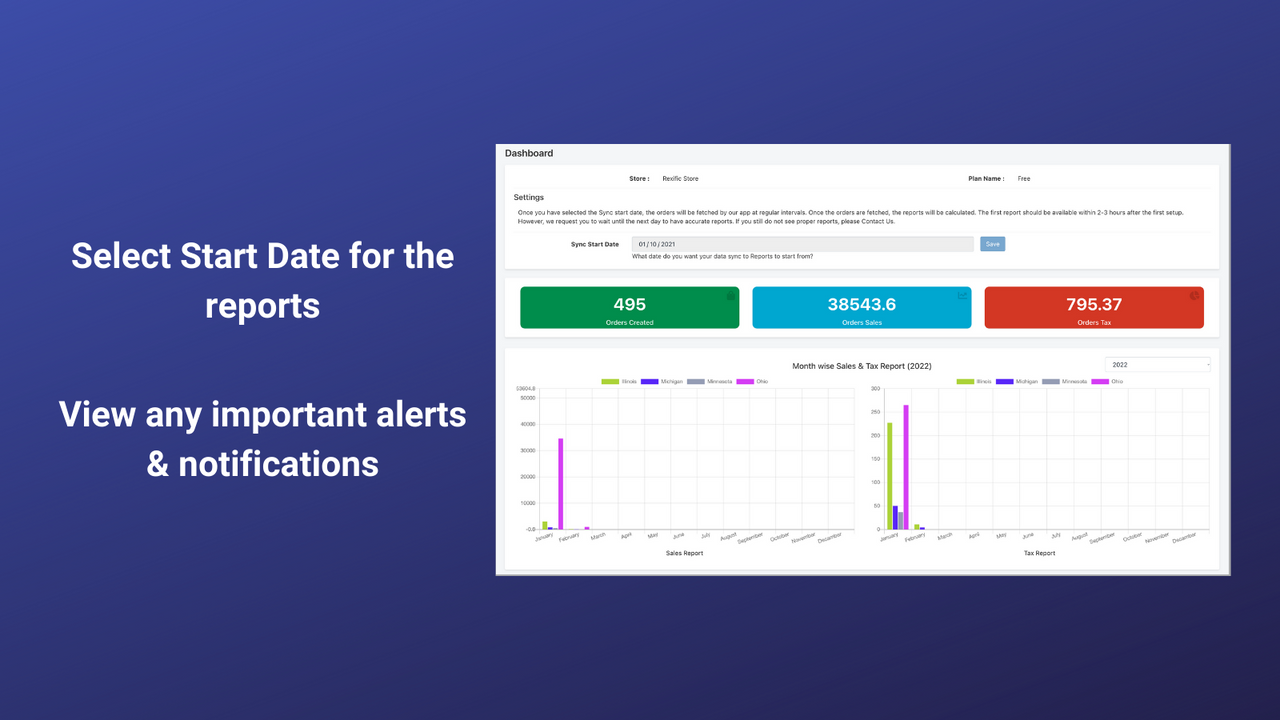

Empower your Shopify e-commerce business with Tax Rex - our seamless all-in-one sales tax solution. From crafting accurate sales tax reports to timely filing on state portals, we've got you covered. Our economic nexus dashboard ensures you never miss a new state's threshold, helping you register in new US states with ease. Focus on growth; we'll handle the tax headaches. Simplify tax compliance today. TaxRex will generate reports based on the taxes already collected in Shopify.

- Timely Autofile: Ensure on-time tax return filings while you focus on business

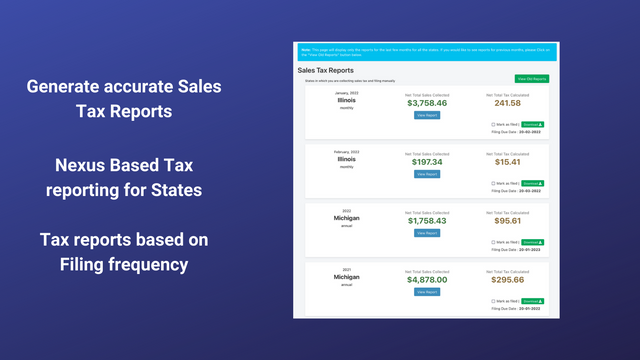

- Accurate Tax Reports: Precise sales tax reports tailored to state's requirements

- Economic Nexus Alerts: Stay informed on new state nexus thresholds

- Effortless State Registration: Simplified new state registration for compliance

- Ability to Ignore orders imported from Marketplaces like Amazon, Ebay, etc

Pricing

15-day free trialSTARTUP

$5/month

$0.03 for every additional order. Autofile at $20 per filing per state. State Registrations at $99 per state

- For stores which have about 200 orders per month

- State Nexus wise sales reports

- Nexus Analysis on Demand

GROWTH

$10/month

$0.02 for every additional order. Autofile at $20 per filing per state. State Registrations at $99 per state

- For stores having about 1000 orders per month

- State Nexus wise sales reports

- Economic Nexus Analysis Dashboard

- State Registration on demand

ADVANCED

$20/month

$0.01 for every additional order. Autofile at $20 per filing per state. State Registrations at $99 per state

- For stores having about 2500 orders per month

- State Nexus wise sales reports

- Economic Nexus Analysis Dashboard

- State Registration on demand

STARTUP

$5/month

$0.03 for every additional order. Autofile at $20 per filing per state. State Registrations at $99 per state

- For stores which have about 200 orders per month

- State Nexus wise sales reports

- Nexus Analysis on Demand

GROWTH

$10/month

$0.02 for every additional order. Autofile at $20 per filing per state. State Registrations at $99 per state

- For stores having about 1000 orders per month

- State Nexus wise sales reports

- Economic Nexus Analysis Dashboard

- State Registration on demand

ADVANCED

$20/month

$0.01 for every additional order. Autofile at $20 per filing per state. State Registrations at $99 per state

- For stores having about 2500 orders per month

- State Nexus wise sales reports

- Economic Nexus Analysis Dashboard

- State Registration on demand

All charges are billed in USD. Recurring and usage-based charges are billed every 30 days.

41 reviews

I can't begin to state how easy this app is to use and how seamless filing taxes is for us! It saves us SO much time and takes the stress away from having to manage this process, filling forms out correctly and submitting payment. Easy and straight forward to use app that allows me to do more important things in our small business. Customer Service is amazing and very timely in their responses and helps navigate any issues that may arise!

Excellent Customer service. I accidently filed a wrong amount and customer service was able to effectively amend the incorrect amount. Everything is automated, no need to worry about having to sit down and figure out taxes for each state. Fairly priced and customer service is easily accessible. 5/5 100%

Great! Extremely simple to setup, add states, setup automations plus great customer service, fast replies. Let's me focus on growing my business and eliminates time spent on these administrative tasks! Highly suggest :)

Worth every penny. I use to dred filing monthly sales tax reports, I mean I still do but they were a nightmare of having to pull multiple reports and struggle to get the numbers to match the state forms. It was like filing Federal Taxes once a month. I knew there had to be an easier way so I searched for a tax program and found Tax Rex! After a small learning curve, nothing hard it was just a matter of adjustment. I now complete my taxes in a fraction of the time. Tax Rex places all the data in one place so its easy to see and input into the state filing system. Customer service is also great. Tax Rex recently added the option of auto filing for my state. I haven't taken advantage of that feature yet but probably will in the distant future.

Amazing. Makes my life so much easier. Great service too! Thank you again.

About this app

Built by Rexific Apps

About Rexific Apps

5.0 average rating

2 years building apps for the Shopify App Store

Ahmedabad, Ahmedabad, GJ, 380015, IN

Support

Send a messagesupport@taxrex.com

Resources

More apps like this