하이라이트

-

미국 소재

앱 소개

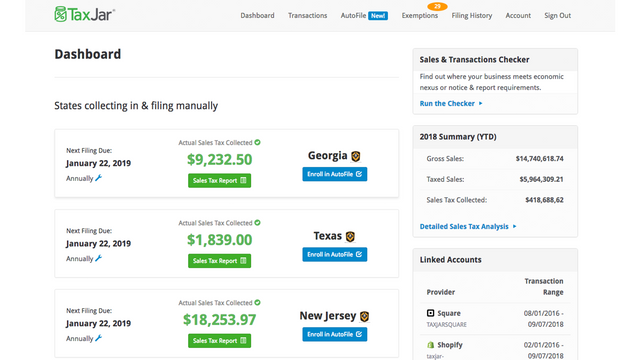

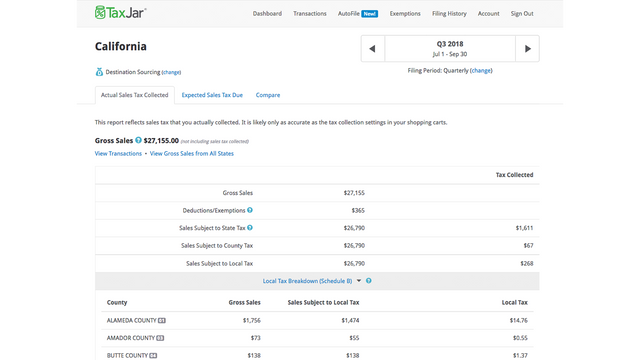

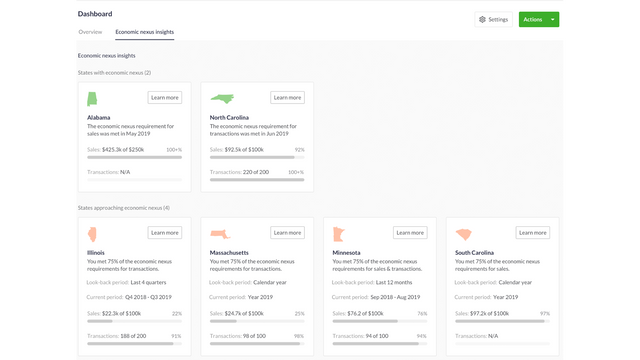

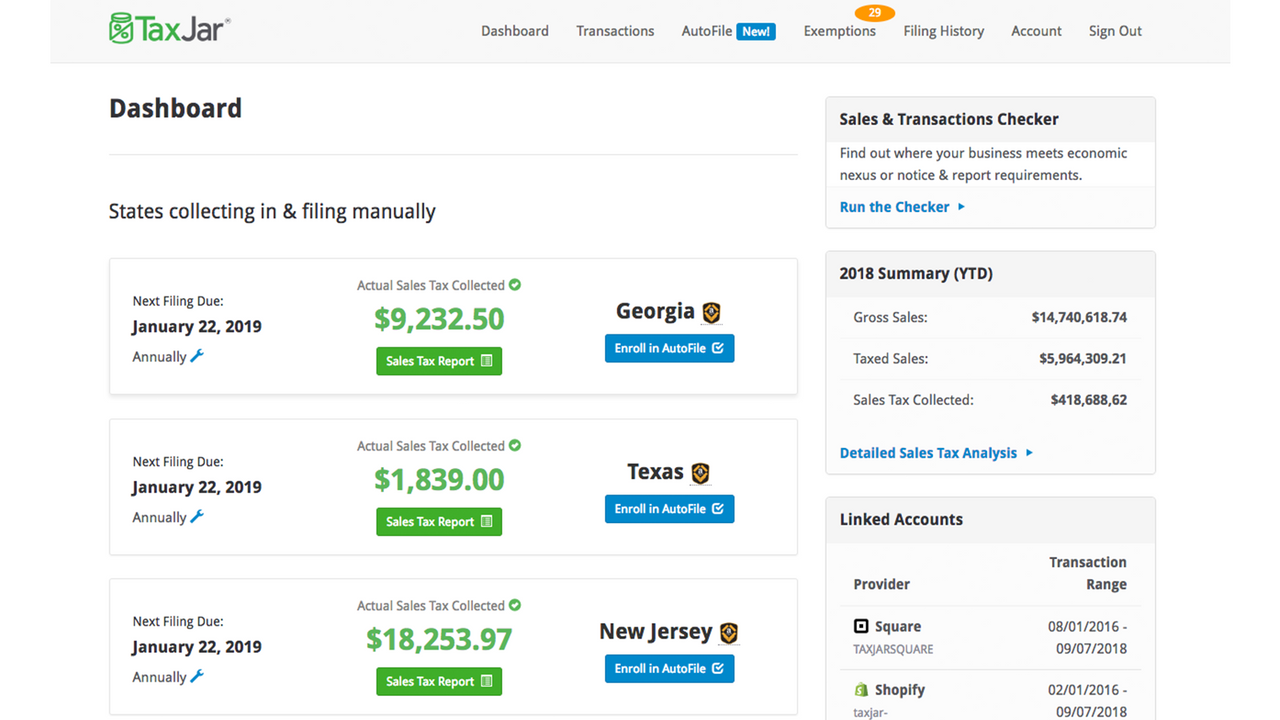

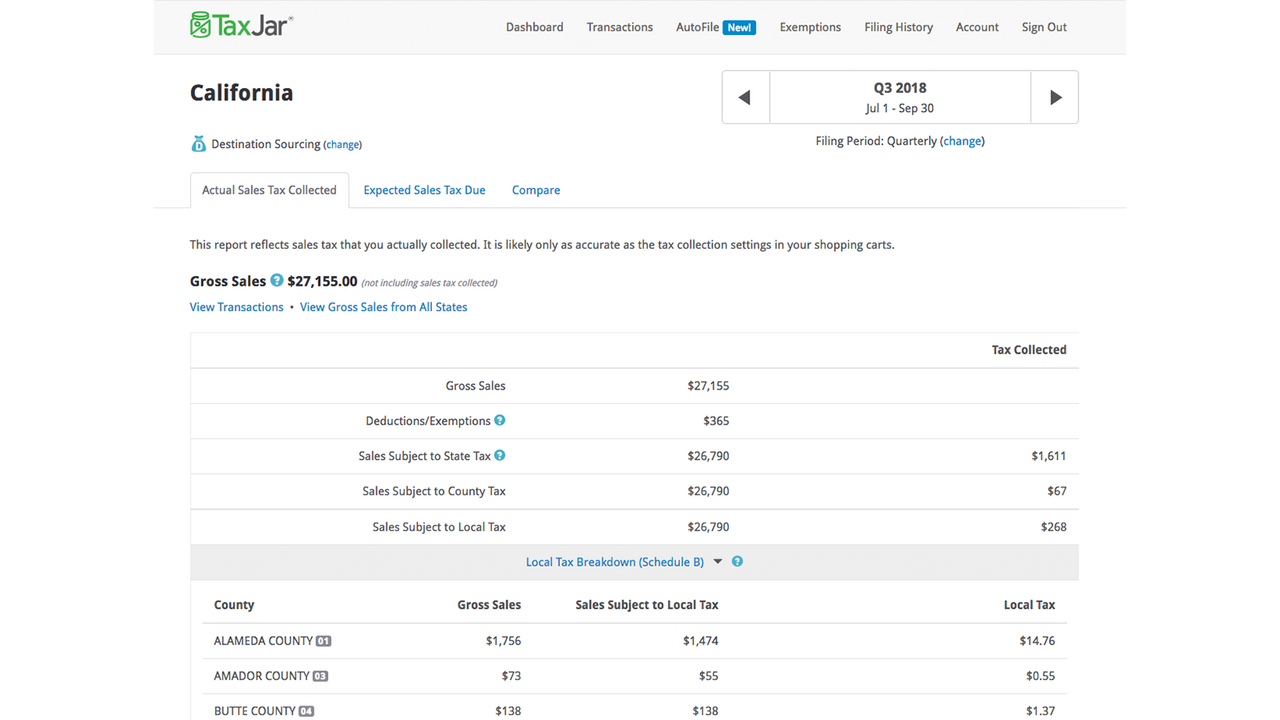

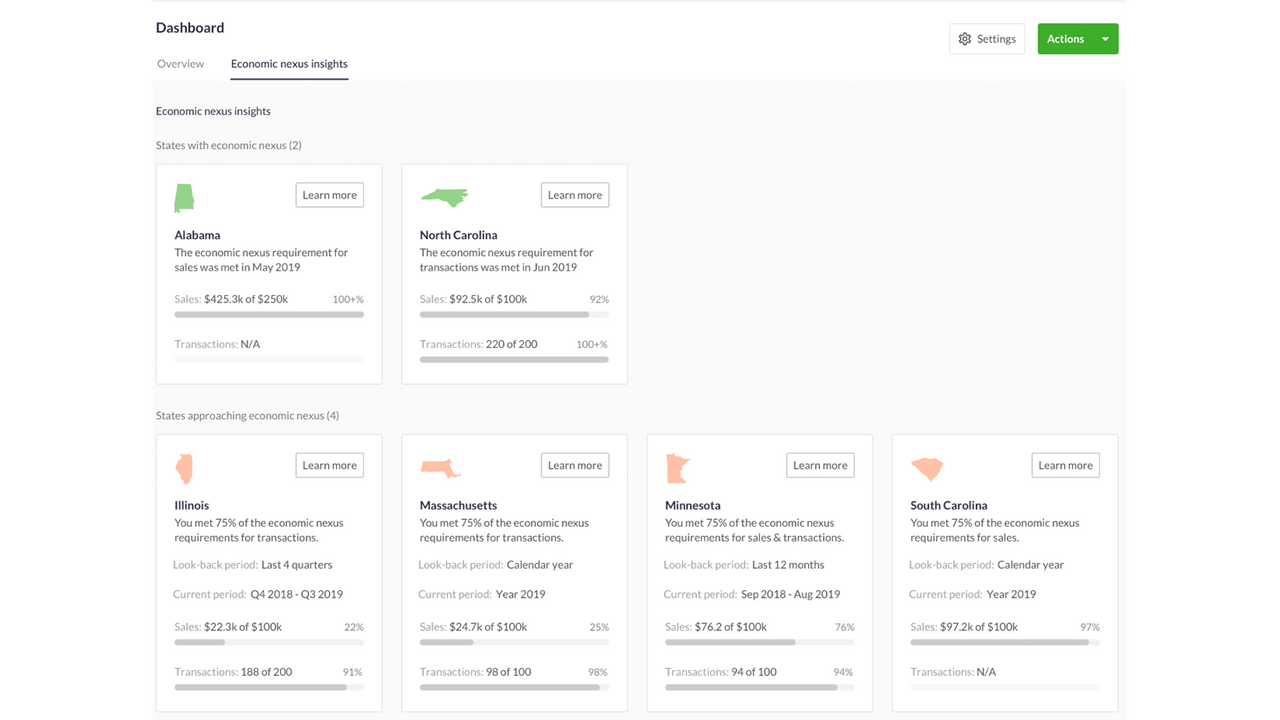

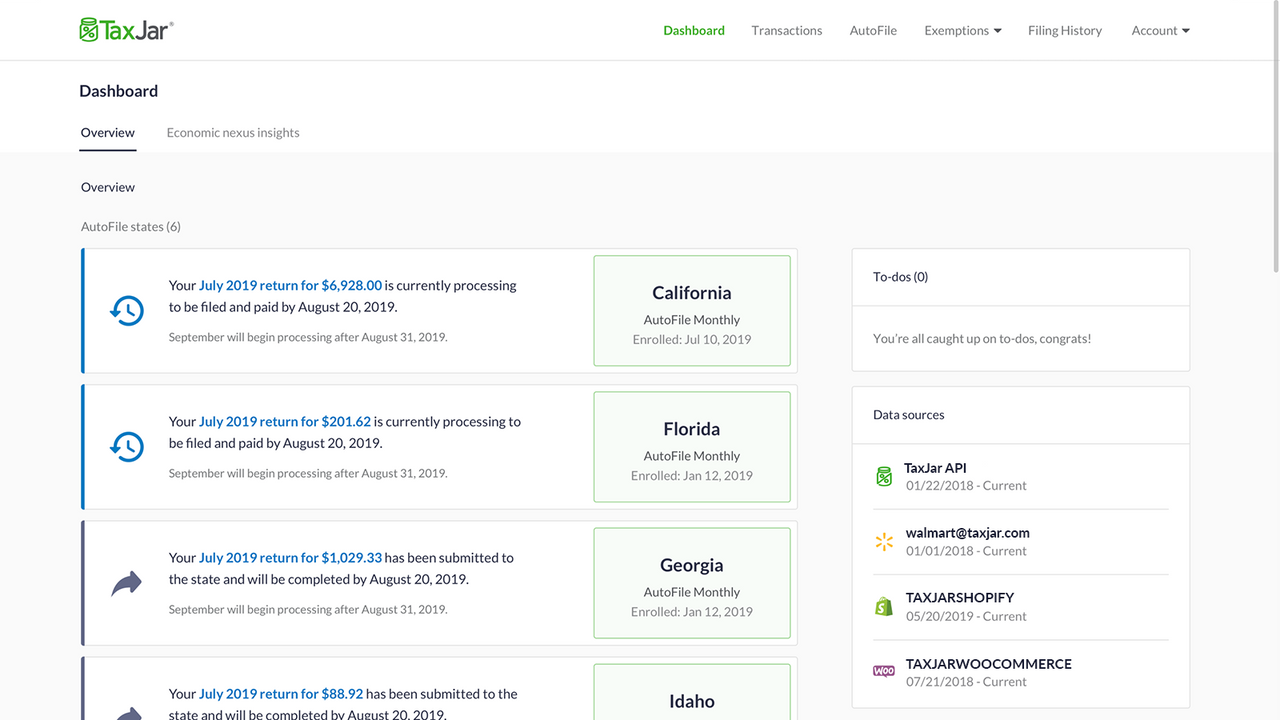

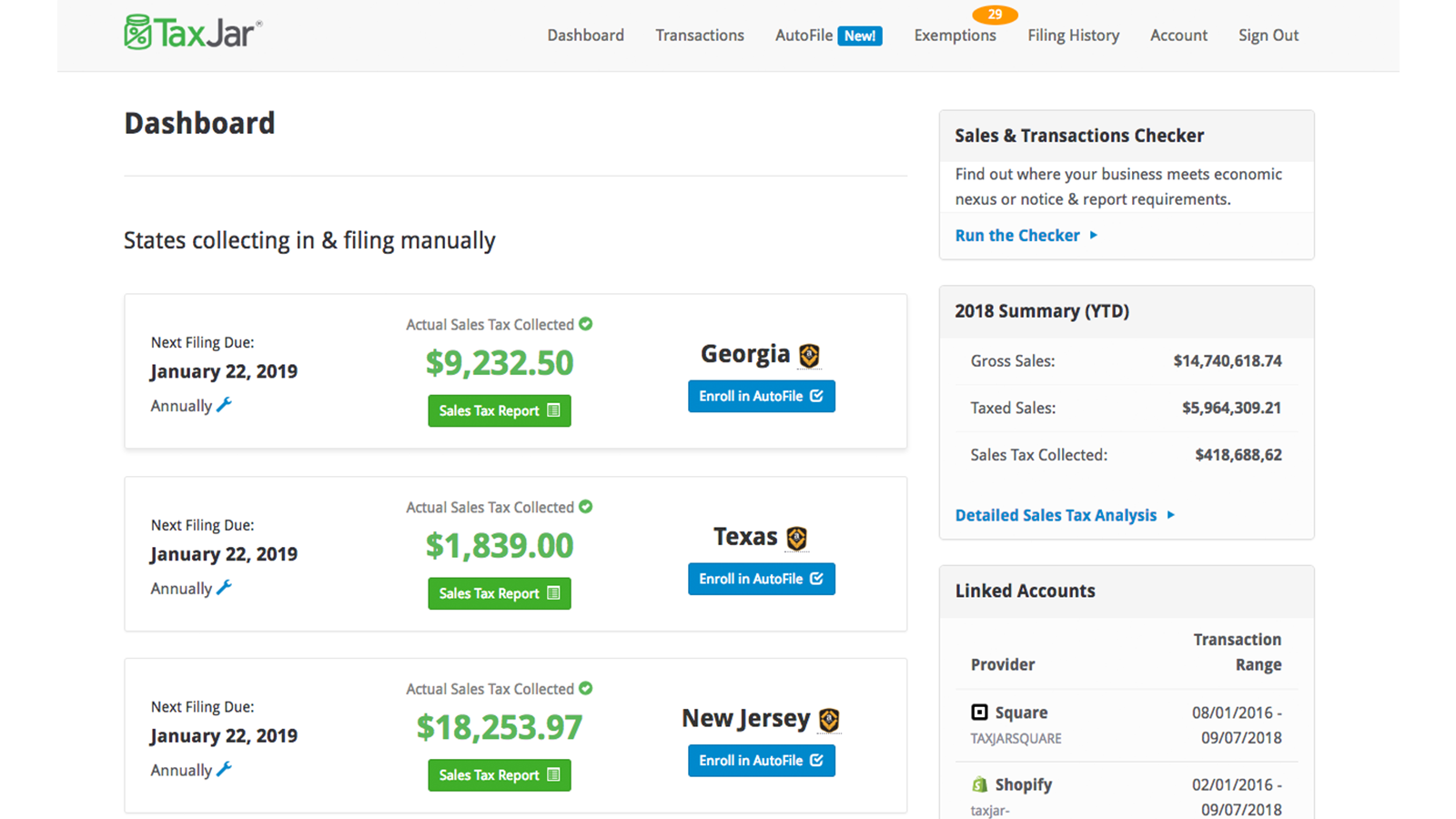

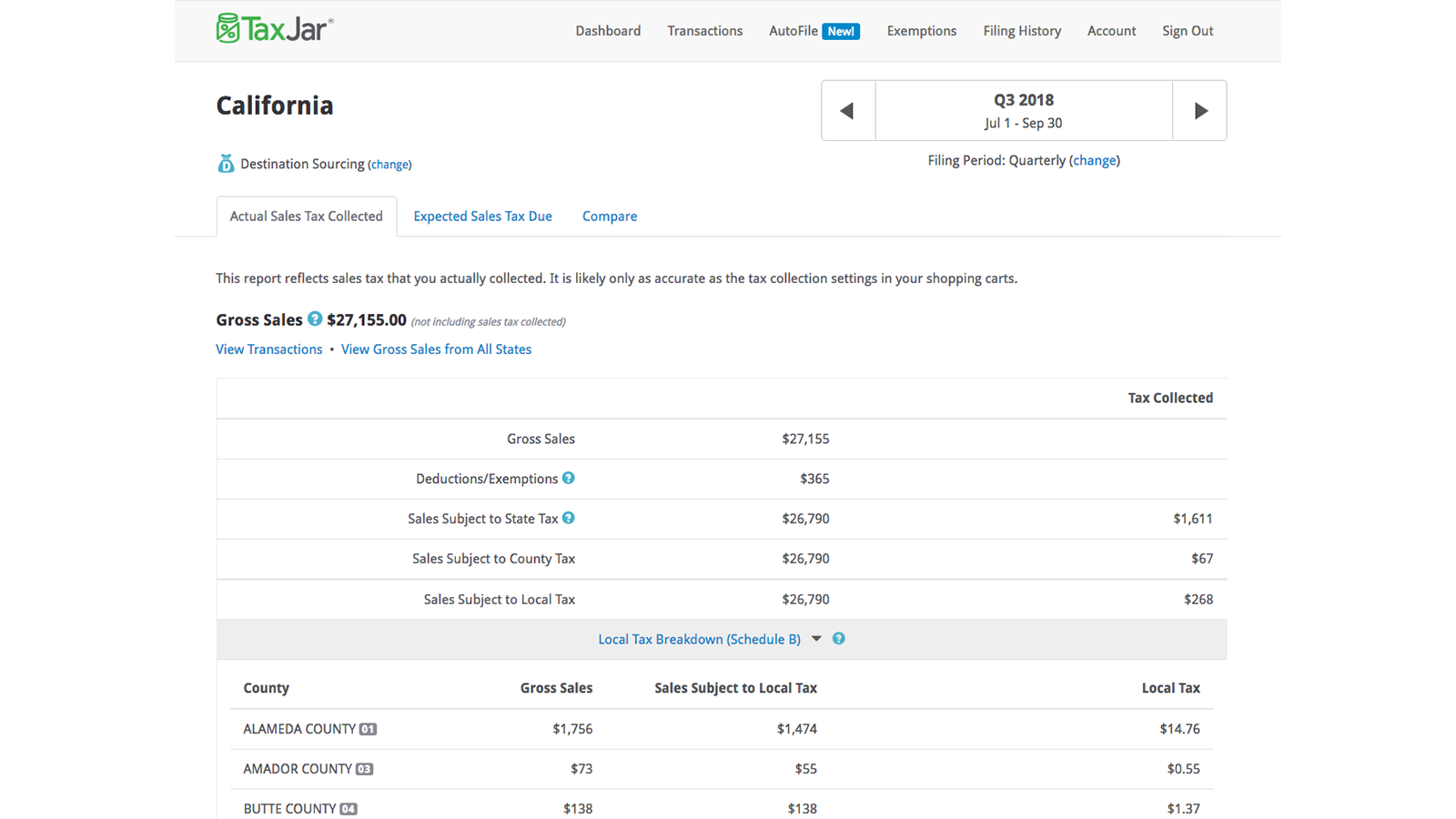

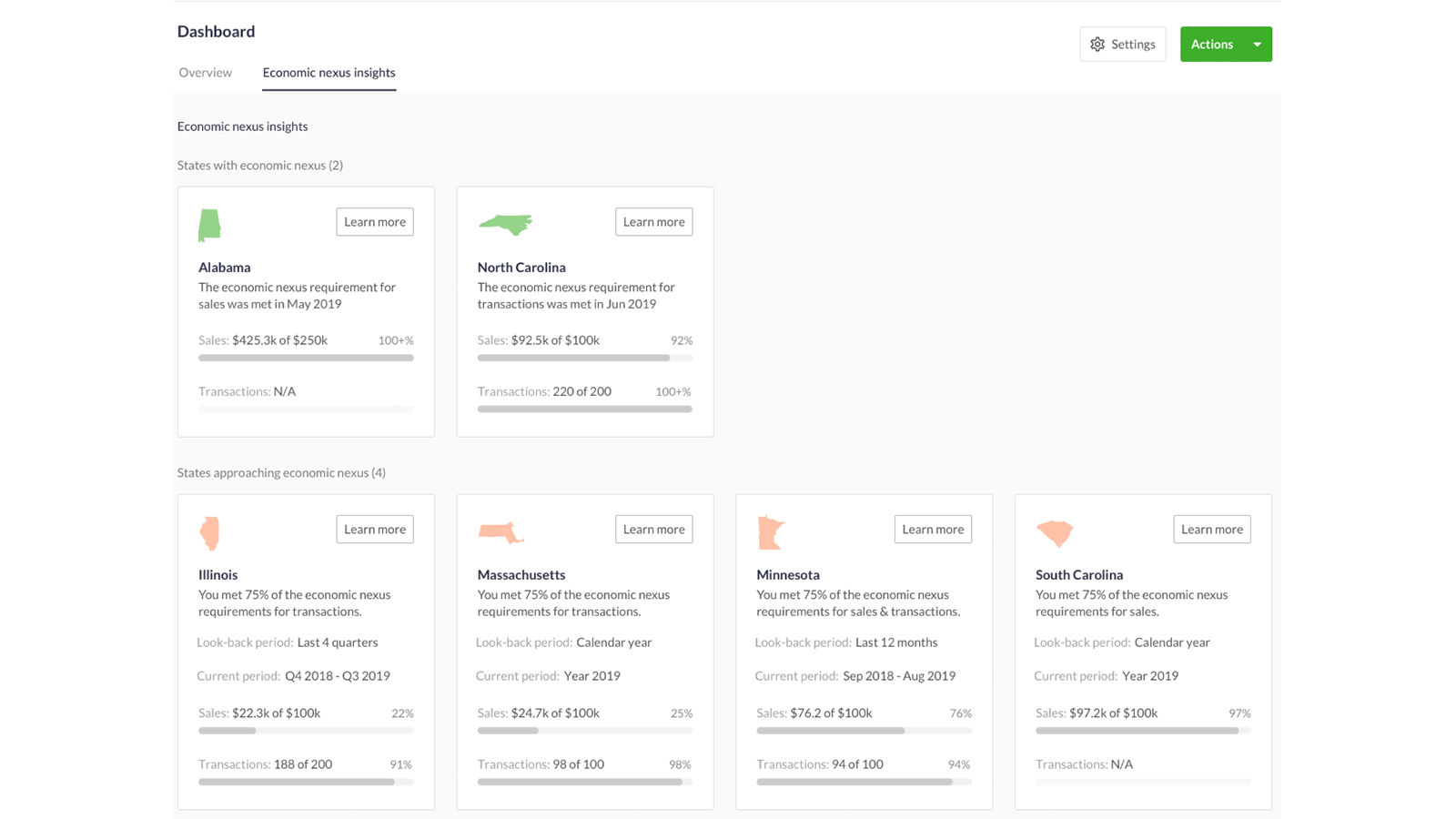

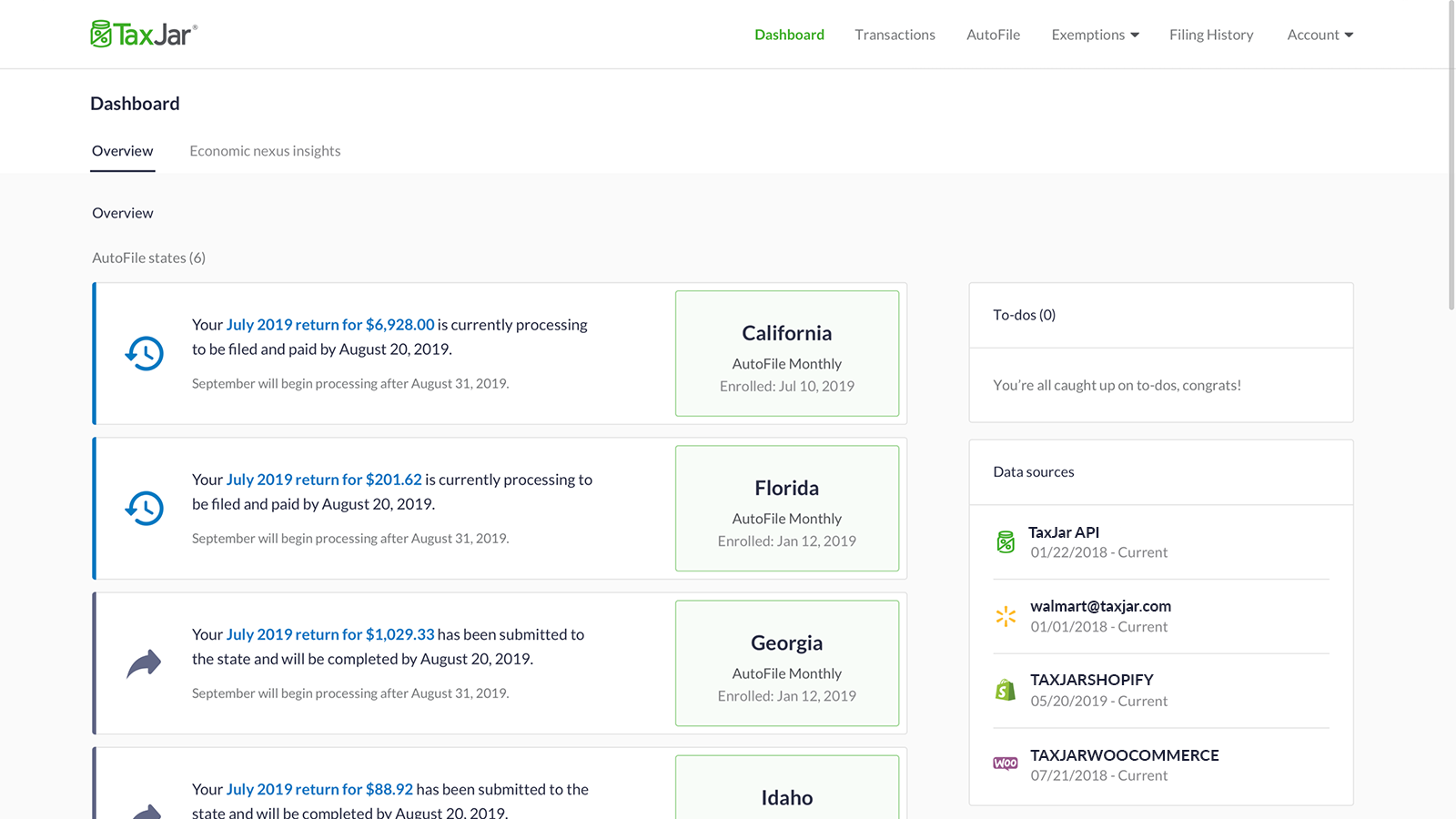

TaxJar helps businesses manage sales tax compliance by automating sales tax calculations and filing.

Paying taxes is a critical part of managing your e-commerce business, but doing it right is complicated. TaxJar does the heavy lifting for you by automating your most tedious tasks, like accurately calculating sales tax rates, classifying products, and managing multi-state filing. Our platform is built with a modern architecture that delivers high performance, reliability, and flexibility as you scale.

- Economic Nexus Insights

- Sales Tax API

- AutoFile

요금제

30일 무료 체험Starter 200

$19 /월

- Up to 200 orders. Additional plans available.

- Reporting and filing requirements

- Simple CSV import

- Email support

- 4 Free AutoFiles per year

Starter 500

$29 /월

- Up to 500 orders.

- Reporting and filing requirements

- Simple CSV import

- Email support

- 4 Free AutoFiles per year

Starter 1K

$49 /월

- Up to 1000 orders.

- Reporting and filing requirements

- Simple CSV import

- Email support

- 4 Free AutoFiles per year

Starter 2.5K

$99 /월

- Up to 2500 orders.

- Reporting and filing requirements

- Simple CSV import

- Email support

- 4 Free AutoFiles per year

Starter 200

$19 /월

- Up to 200 orders. Additional plans available.

- Reporting and filing requirements

- Simple CSV import

- Email support

- 4 Free AutoFiles per year

Starter 500

$29 /월

- Up to 500 orders.

- Reporting and filing requirements

- Simple CSV import

- Email support

- 4 Free AutoFiles per year

Starter 1K

$49 /월

- Up to 1000 orders.

- Reporting and filing requirements

- Simple CSV import

- Email support

- 4 Free AutoFiles per year

Starter 2.5K

$99 /월

- Up to 2500 orders.

- Reporting and filing requirements

- Simple CSV import

- Email support

- 4 Free AutoFiles per year

모든 비용은 USD(으)로 청구됩니다. 반복 요금 및 사용 기반 요금은 30일마다 청구됩니다. 모든 요금제 옵션 보기

리뷰 118개

Consider this review a serious caution. I wish it were possible to rate this app with zero stars. The support team is virtually non-existent, and on the rare occasion you do receive a response, it's clear they lack any real understanding of their own service. We're currently paying $349 monthly for the Pro plan, which is set to increase to $499 next month. Additionally, they fail to offer SST service as they aren't a certified service provider, which is concerning given the seriousness of sales tax compliance and the risks associated with non-compliance. I strongly advise avoiding this service.

Horrible Support. Based in India. Canned Responses, Zero interest of helping you resolve problems with THEIR APP.

AWFUL. HORRIBLE. DO NOT USE THIS APP!!! We've been using for about 4 years but now, Support is worthless ever since they were acquired by Intuit. It literally takes weeks to get an email reply. Stay away!!

The customer support on this app is ATROCIOUS. We were locked out of our account for OVER a week. Their customer support is in India and each response is 24 hours or more. It's fine as long as it is working. The customer support is one thing but one month when we imported older orders into Shopify it counted ALL the orders even though the dates were over a year old. We had AUTO file set and it deducted $85K from our bank account and it took a few days to get it back. I am SO DONE.

Pretty bad. A migration issue resulted in an overpayment of my taxes by thousands in one state and they are now not responding to my emails.

앱 소개

이 앱과 비슷한 더 많은 앱 보기