Featured images gallery

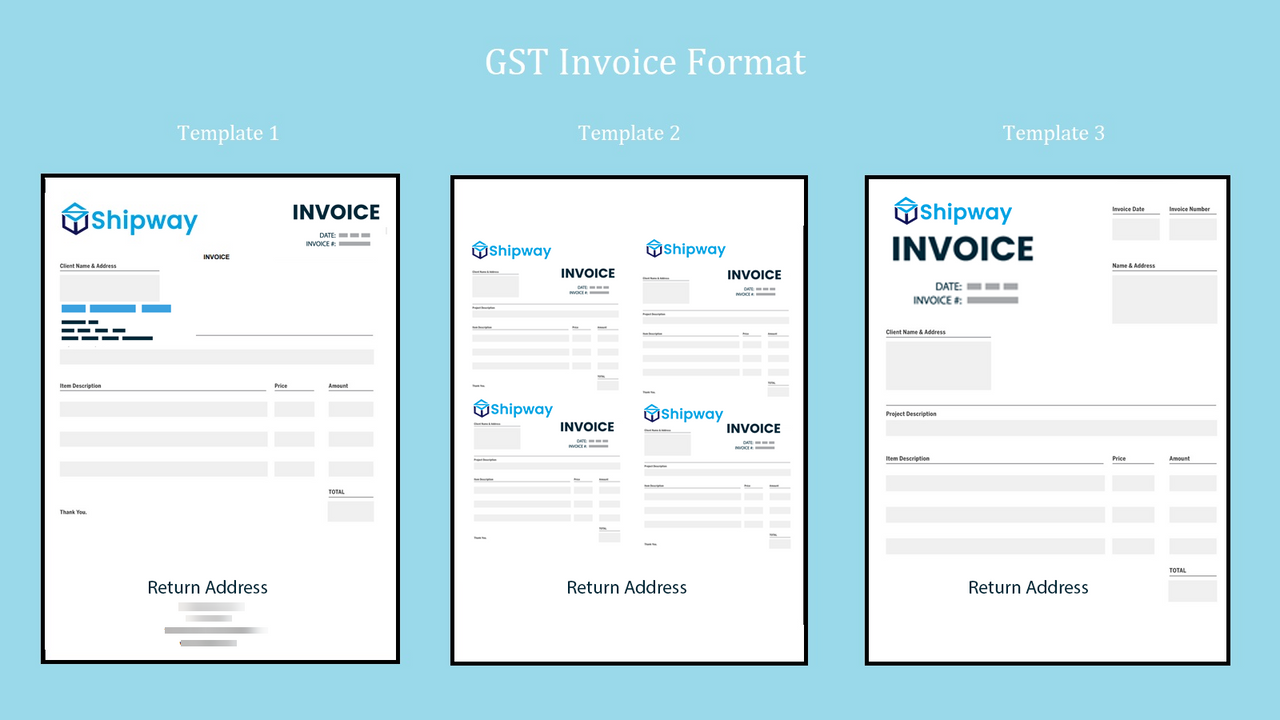

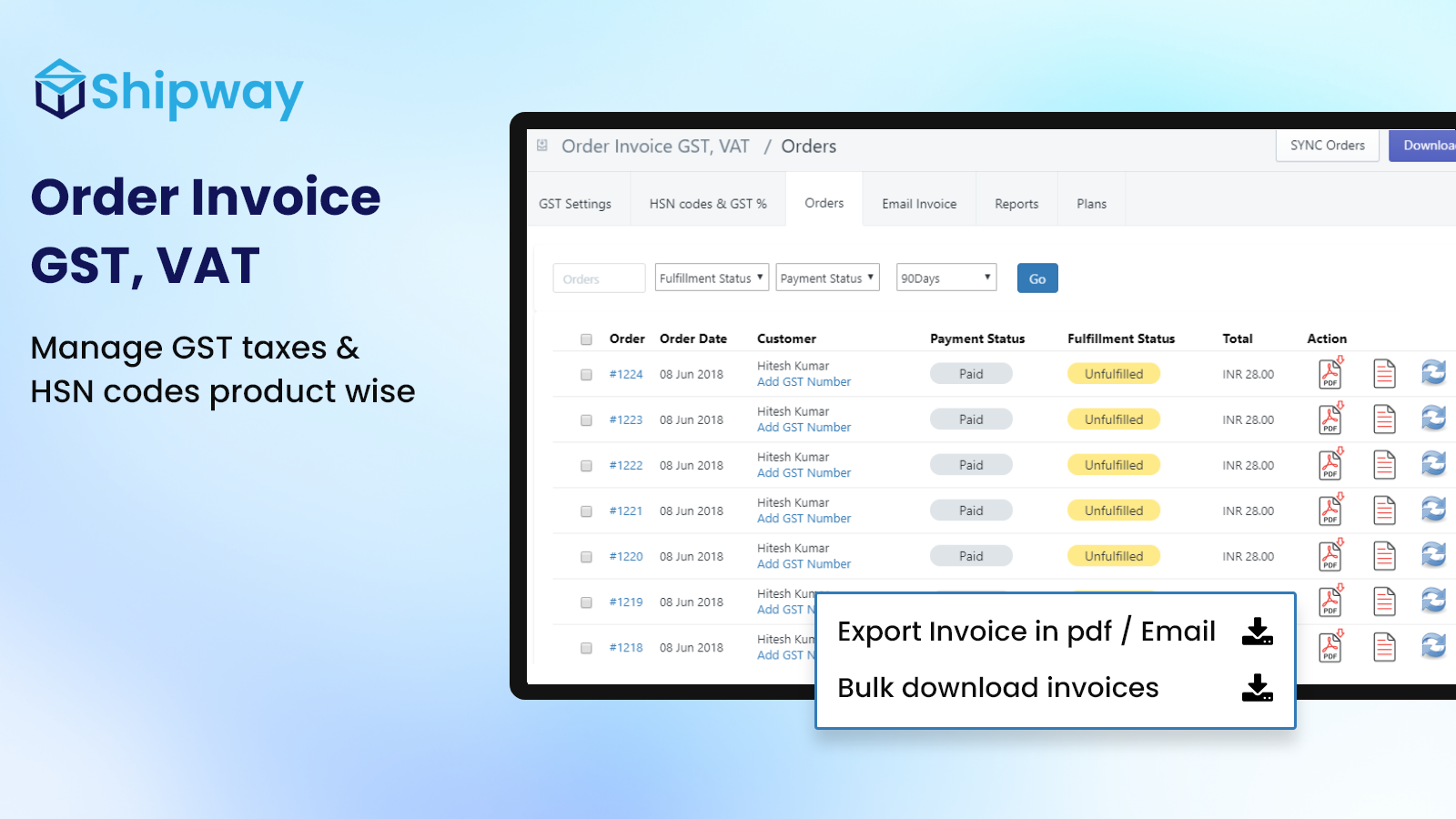

# Invoicing Under GST Under GST invoicing rules and formats have been notified covering details such as supplier’s name, shipping and billing address, HSN Code, GST Tax Calculation. As per the new government norms, GST is applied differently for intra-state and inter-state sales. GST levied on the intra-State sales by the Centre is known as Central GST (CGST) and that by the States is known as State GST (SGST). Whereas for inter-state sales, only IGST (Integrated GST) is applied which...

Categories

Reviews (7)

Happy with the work till now. Have been using the app for some time now. Generating GST compliant invoices at a click. Great Work!

The only app you need when it comes to GST compliant invoices in India!

Also the only app we found in the store that lets you set different tax % at SKU level. Ideal for stores that sell products that fall into different GST slabs!

The team is very supportive & try fixing issues if any at the earliest!

They help us set up their app in my store too!

Super app , improved my working , onjection is imply great , they improve their software as per client , In love with this company.

the app is good and fulfills all purposes. The only thing i would request is to not send mails as soon as we click sync orders. As sometimes we do not want to send invoices to all customers as few orders might be from a POS software integrated with gst of another state.

Thanks!

I am using this app to generate Invoices and have linked it to Shopify account, but I am unable to open it now as every time I click on the app its showing error and nothing is coming up and my subscription money is getting deducted ! Please support this is not acceptable

As we have check its been working fine with our app. Screenshots also sent of the staffing account.

Request you to please check it again.

Support

App support provided by Shipway .

Resources

Launched

August 30, 2017